The difference between decentralized and centralized stablecoins

September 28, 2023

Bitcoin and Ethereum are two of the cryptocurrencies in the market; we all know that the cryptocurrency market is so young and volatile, making it hard for new traders to enter. They often find it hard to trust a volatile market, and some traders cannot tolerate the high volatility of the currency Market. On the other hand, many Traders use cryptocurrencies for international transactions.

These traders prefer stablecoins, which can be considered the equivalent of a dollar in the digital world. The value of stablecoins is stable and a better option for conducting digital transactions. Stay tuned with Aron Groups to learn about stablecoins, their advantages, and why they are so popular in the cryptocurrency market. Eventually, we will discuss the differences between decentralized and centralized stablecoins.

Table of Contents

What is stablecoin?

The value of stablecoin is purged to fiat currency or commodity. Hence, the volatility is no. Stablecoins are cryptographic assets run on blockchain technology. As they are less volatile compared to other cryptocurrencies, they are more preferred for conducting financial transactions.

Using stablecoins, you can buy cryptocurrencies faster and easier in decentralized exchanges. With the growing number of blockchain and crypto projects, the number of decentralized exchanges that do not accept dollars and other Fiat currencies has risen, and if you want to trade in these exchanges, you need stablecoins.

Investors who were fascinated with the idea of cryptocurrencies but didn’t want to get involved with the volatile market found stablecoins interesting. The first and the most significant characteristics of stablecoins are their stability and the fact that their value is hedged to a real-world currency.

read more: What is the difference between Tether and DAI?

Why stablecoins are beneficial for the cryptocurrency market?

Stablecoins are perfect for providing liquidity and reducing the limitation. The high volatility of the Bitcoin Market is frightening for some Traders; they’re worried about losing their capital. In this, stablecoins are considered a perfect solution that allows investors into the cryptocurrency market and provides liquidity without exposing the capital to risk.

On the other hand, financial institutions, investors, and banks use stablecoins to purchase cryptocurrencies. Big investors use risk management tools, and stablecoins are a safe and practical asset to invest in.

Stablecoins reduce the cost of transactions and make broad transactions easier and faster. On the other hand, when using stablecoins, you don’t need to travel to exchange fiat currency for cryptocurrency, and you can enter trading positions faster.

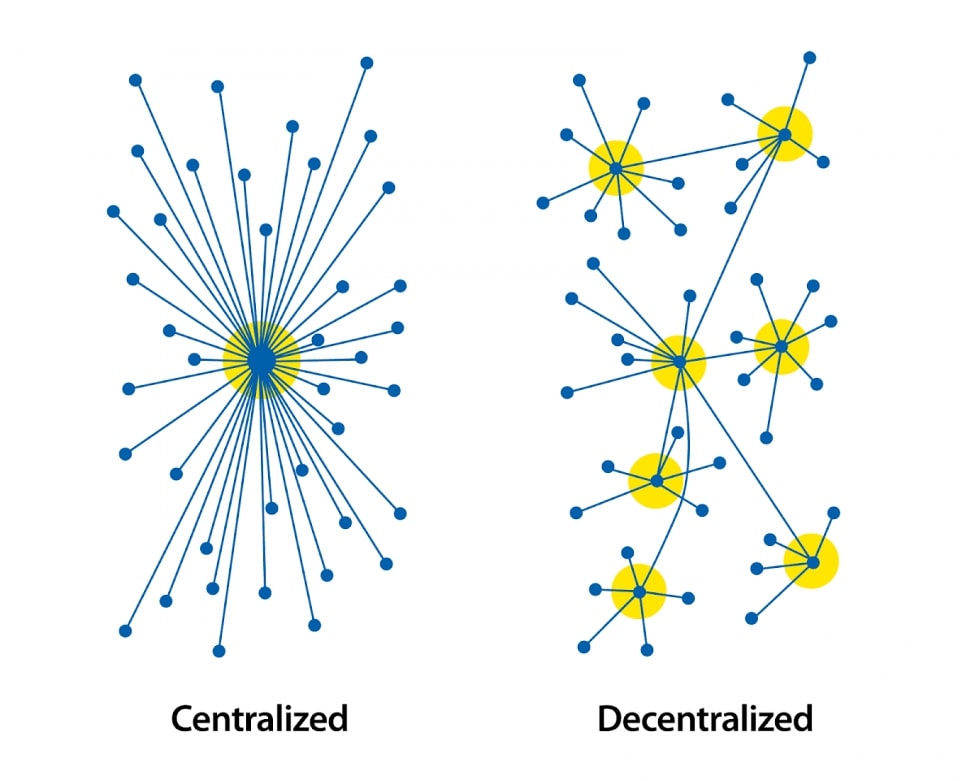

Centralized stablecoins

When the value of a stablecoin is backed by a traditional currency like the US dollar, you’re dealing with centralized stablecoins. There is a single entity controlling and managing these stablecoins, and when there is a single entity in power, we are dealing with a centralized financial system.

When you’re using stablecoins, you are keeping your investment away from the market’s volatility while having the chance to benefit from the potential in the cryptocurrency Market. In this case, you can use stablecoins like USDT and USDC.BUSD and TUSD.

However, some analysts believe that centralized stablecoins jeopardize the very nature of the cryptocurrency Market, which is decentralized and Democratic. The purpose of creating digital currencies was to delete the middleman and cut the hands of central authorities.

Pros and cons of stablecoins

The first advantage of stablecoins is their accessibility. They are easy to use, making them a perfect financial system solution. Due to the decentralized nature of stablecoins, financial systems can easily adopt them. For every stablecoin in the market, a fiat currency is held in reserve. So, suppose you don’t even believe in the idea of cryptocurrencies. In that case, you can use the advantages of the new market without getting involved in a volatile Market, which makes stablecoins interesting investment opportunities.

read more: What is the difference between USDT and USDC?

Decentralized stablecoins

The value of decentralized stablecoins is paged to an algorithm or other cryptocurrencies. You can easily monitor the reserve and transactions within the project as everything is stored on the blockchain. In this type of project, the supply and demand are determined by rules and incentives. For example, if the price of a stablecoin exceeds the target, the supply will increase to reduce the price. On the other hand, if the price decreases by a certain amount, tokens will be burned to reduce supply and price.

To use this type of stablecoins, you should collateral your cryptos. The amount of collateral is to be determined by democracy from status to maintain a stable value for the decentralized stablecoin. TerraUSD, Dai, Fra, and MIM are examples of decentralized stablecoins.

read more: Crypto Exchanges

Pros and cons of decentralized stablecoins

The first and most important advantage of decentralized stablecoins is their resistance to censorship. Information is transparent in these projects, and as there is no central authority, there is no censorship, and everyone has equal access to the network’s information.

People who live in underdeveloped countries or governments that try to transfer wealth freely benefit from these centralized stablecoins.

But on the other hand, these cryptos are not stable. Although the purpose of creating stablecoins is to provide stability, the goal is hard to achieve due to the decentralization of the projects.

The first disadvantage of stablecoins is they are centralized. Which means you have to trust a third party. Another disadvantage of stablecoins is the lack of transparency. Stablecoins claim to have precise audits, but there was no transparency, and as a trader, you can’t ensure that your stablecoins are back or a fiat currency for real.

In the end

the comparison between decentralized and centralized stablecoins continues, and the community chooses them according to their preferences. Each of these stablecoins provides advantages and disadvantages, but decentralized stablecoins are more transparent and resistant to censorship. If you are interested in the decentralized nature of cryptos, you might prefer to choose decentralized stablecoins.

As a trader, you should always do your research and learn about new progress in the blockchain and cryptocurrency industry. Only by doing research should you be able to choose the best cryptocurrency to invest in. With Aron Groups, you are provided with different investment opportunities like currencies, cryptocurrency, Commodities, and stock to create a diversified portfolio. To understand the stability of stablecoins, try to wait and use a demo account. Demo accounts are perfect for testing trading ideas and new strategies.