What is the fear and greed index, and how to use it?

September 26, 2023

In an ideal World, the price of currencies and financial instruments will always be stable, but that is not the case with the forex market. One of the primary characteristics of the forex market is price fluctuations and volatility. As a trader, you should be able to figure out the market movers and factors that might influence prices. Traders’ emotions greatly influence prices; fears, hopes, regrets, and frustration, along with other human emotions, directly impact currency prices.

When we talk about the market sentiment, we’re actually talking about traders’ sentiment that will influence prices. Analysts over the years figured out that people’s emotions can change the course of trends in the market, and they introduced the fear and greed index. In this article, we at Aron Groups will discuss the index and its influence on prices. Next, it will help you calculate the index and interpret it correctly.

Table of Contents

What is the Fear and Greed Index?

The fear and greed index is the indicator used in different financial markets and was introduced by CNN. This indicator demonstrates the market sentiment and the impact of it on prices.

As a trader, you will find useful information Just by monitoring this index. It will provide useful information about the current trend and its future Direction. The fear and greed index is updated weekly, monthly, and yearly, so you can always access the latest information.

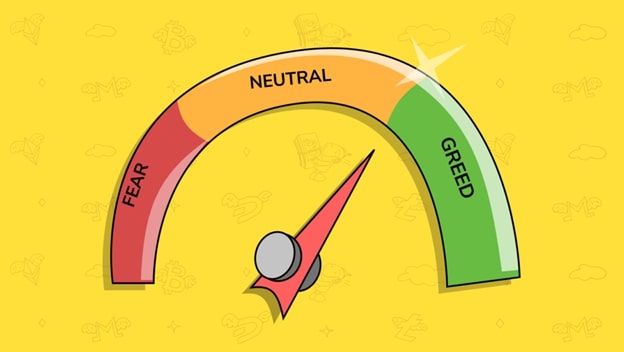

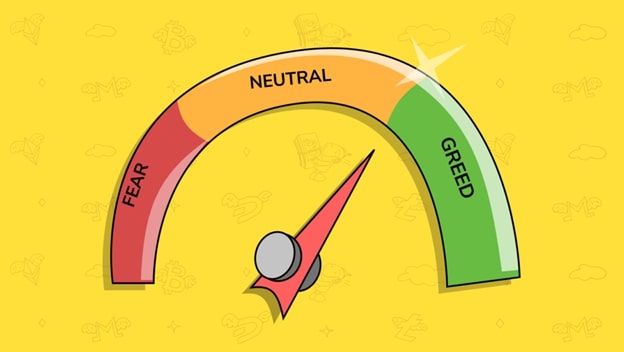

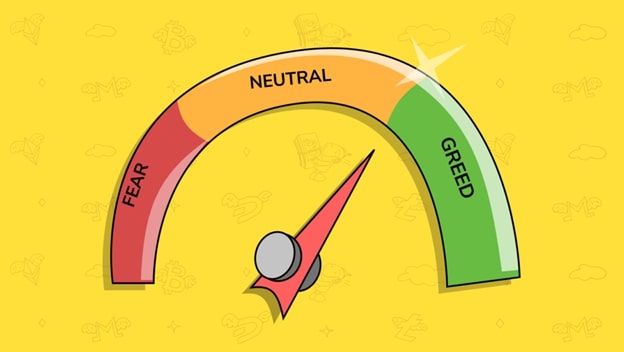

The logic is that too much fear will lead to price decline while too much greed will lead to unnatural price rises. The Fear and Greed Index is an indicator showing an amount between 0 and 100. Any number below 50 indicates that the market is filled with fear, and any above 50 indicates that greed dominates the market. Excessive fear or greed will change market prices.

read more: Select 6 Common Forex Trading Mistakes

Why is it important to calculate the fear and greed index?

The forest market is hugely under the influence of Traders’ sentiment, as people tend to open and exit positions based on their emotions. Many acts out of fear of missing out. They act aggressively when seeing red spots on the charts. The Fear and Greed Index: Save your time and avoid unnecessary trades. Fear makes traders anxious and distracts them from profitable positions. On the other hand, excessive greed leads to market correction.

How to calculate the fear and greed index

There are 6 different factors you should take into consideration when calculating the fear and greed index, which are as follows:

1. market momentum

this indicator, for example, compares the price of SMP 500 with a 125-day moving average, and when the moving average is higher, the greed increases in the market. When the indicator is close to 0, the market momentum has slowed down.

2. Relative price strength

The indicator shows trading volume over a period of time. When the highs are more than the lows on the chart, the market mode is greedy. When the number of lows is higher, the market is filled with fear.

3. Price breadth

Trading volume and trading prices are perfect indicators of market sentiment. This indicator shows the trading volume on good and bad days in the market. The more interested they are, the greedier the market is. The more investors open short positions, the more afraid traders are.

4. Put and call options

The number of put and call options shows how Traders feel about the market’s future.

5. Market volatility

This indicator shows Democrat volatility according to the 50-day moving average. As this indicator increases, so does the fear in the market. As this indicator declines, Traders feel more optimistic.

6. Demand for a safe haven

When traders are worried about the future of the market, they act out of fear, looking for a safe Haven to a store of value. In order to find a safe haven, you need to use the fear and greed index. The higher the demand for buying bonds, the more trader feels greedy. On the other hand, when Traders lose the appetite for buying bonds, they are afraid.

How to interpret the fear and greed index

As touched upon above: the lower the fear and greed index is, the more cautious the market is. The higher the fear and greed index is, the more optimistic traders are.

- 0-25 indicates excessive fear.

- 25-45 indicates moderate fear.

- 45-55 indicates a neutral market.

- 55-75 indicates moderate greed.

- 75-100 indicates excessive greed.

If you agree with this index’s logic, you can use it to make trading decisions. Any number below 45 indicates fear, and traders pay the least to buy an asset. When the indicator is higher than 55, the greed rises in the market, and traders feel optimistic and open more positions. The closer the index is to 0 or 100, the more market sentiment impacts prices.

The useful information

The fear and greed index provides you with useful information, and by monitoring this index, you can speculate prices and market trends.

How do you feel about the market?

Let’s say you want to sell everything, and the fear and greed index is lower than 25; in this case, you need to wait and think more. This might not be a good time to sell your assets.

If you are aggressively buying when the index is high, you should stop. Stick to your strategy and trade the code into your plan. Remember that you shouldn’t change your strategy based on market sentiments.

The benefit of using the fear and greed index

Forex is that it is a dynamic market that can surprise you with price fluctuations. Feel always lead to more cells; greed leads to more purchase.

The fear and greed index tells you how to interoperative your next position. If it always sticks to your trading strategy. As a trader, you need to find the best time to exit and enter positions, and the fear and greed index is a great source of information.

To learn more about using this index, you should test the information you gathered in a demo account before trading Korean money. In order to become a consistently profitable Trader, you need to know and use different tools and indicators in the forex market. The more you are equipped with useful tools, the more profit you make trading in this market. In Aron Groups, you will be provided a demo account to help you test your trading ideas before entering a real position.